Amazon sellers often encounter an unexpected hurdle when launching their online business. For newcomers to online selling, navigating tax requirements can be confusing. It's challenging to determine the rules for charging customers VAT and whether to include VAT in the product price.

In this article, we will explore the various scenarios that Amazon sellers may encounter when operating their e-commerce business. If you're new to Amazon and e-commerce in general, it's essential to understand the different ways to handle orders, which affect your VAT obligations.

When selling on Amazon, you must choose a fulfillment option - fulfillment refers to the process of preparing and delivering customer orders. This decision is crucial for new sellers. Your options primarily boil down to two scenarios:

Self-Fulfillment (Fulfilled by Merchant, MFN):

Storing, packing, and sending orders yourself. This is what Amazon refer to as Fulfilled by Merchant, which in their terminology is also called MFN (Merchant Fulfilled Network). While it sounds complex, it just means that you will be responsible for order execution and Amazon will expect you to upload tracking numbers for each order and deliver to the customers in time. As is the case in all aspects of life, the do it yourself approach is always cheaper, but involves spending time learning the craft and ongoing effort.

Using Amazon's Warehouses (Fulfilled by Amazon, FBA):

Putting orders on autopilot using an Amazon FBA warehouse is a compelling proposition. Amazon operates warehouses in 8 European countries - Germany, France, Italy, Spain, Czechia, Poland, Netherlands, Sweden. They call the service FBA (Fulfilled by Amazon) and with it, Amazon handles packing and shipping of each order automatically. However, this convenience comes with FBA fees charged per order.

Do I Need to Register for VAT to Sell on Amazon in Europe?

Now, let's discuss VAT. How does your fulfillment setup affect your tax obligations? A crucial point for new sellers to understand is that sending stock to a warehouse abroad, in a country where your business isn't established, requires VAT registration.

Now, let's discuss VAT. How does your fulfillment setup affect your tax obligations? A crucial point for new sellers to understand is that sending stock to a warehouse abroad, in a country where your business isn't established, requires VAT registration.

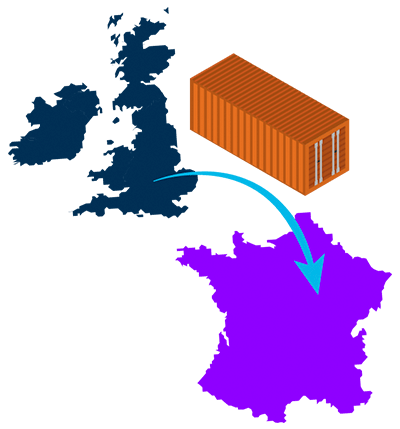

For example, if you're a seller from the United Kingdom and you opt for the Amazon FBA program, sending stock to France, you must register for VAT in France as a foreign company. This entails filing regular returns and paying VAT for sales to French customers. The same applies if you choose the self-fulfillment route but use a 3PL warehouse in France — you still need to register for VAT in France.

What Does It Entail to Register for VAT in a Foreign Country?

You're likely familiar with VAT, a consumer tax imposed on the value added to goods and services. In your own country, your business pays VAT on goods and services it purchases (input VAT) and collects VAT on the goods and services it sells (output VAT). The VAT owed is essentially the difference between input VAT and output VAT.

For instance, if your business buys raw materials for €1000 and sells a product for €1400, the tax is imposed on the €400 of added value.

Businesses engaged in e-commerce and selling to foreign customers often grapple with how VAT works when registering in a foreign country and maintaining two VAT numbers — one in their own country and one in another where they keep stock. It becomes especially perplexing when stock is imported or sourced from the business's country of establishment (e.g., the UK) and sent to an Amazon warehouse (e.g., in France) for sale to French customers.

Sending Stock From Your Home Country to an Amazon FBA Warehouse

Most new sellers have trouble determining what happens to input and output VAT when you transfer stock from one country to another.

Let’s say you acquire goods in your country of establishment and pay input VAT there. If you were to transfer these products to an Amazon warehouse in Europe (e.g. in France), you would no longer have the opportunity to collect input VAT in your country, as the product would not be sold there. It will be sold in France, but how would you calculate the difference between input VAT and output VAT if those did not occur in the same country? The answer is simple - you can apply for a VAT refund in your local jurisdiction by supplying the required documents for the stock transfer.

The example above is a simplified one, where all the stock your business sells is transferred abroad, but acquired in your home country. In a more realistic scenario, your business will likely have sales in its home jurisdiction too and if those sales generate enough output VAT to be collected to offset the input VAT on the stock sent to France, you will not need to apply for a refund at all.

Whichever your situation, what’s important is that stock transferred can be accounted for and no VAT overpayment will occur, regardless of the complexity added by multiple VAT registrations in Europe.

When an ecommerce business registers for VAT in a foreign country where they keep stock (in a hired 3PL warehouse or an Amazon FBA warehouse), in most cases their monthly VAT return will only have output VAT (that is tax collected from customers, which needs to be paid), unless they acquired the goods in the same country. If the goods were acquired in a different country, for example, the country of establishment of the business, then a VAT refund procedure may be required.

Does VAT Work the Same When You Register in a Foreign Country?

A frequently asked question is whether you can accumulate input VAT in a foreign jurisdiction to offset it against the output VAT there. The answer is yes. For instance, if you're based in Romania but wish to procure stock from a French company and directly dispatch it to an Amazon FBA warehouse in France, it's permissible. The goods you acquire are deemed supplied in France, making the input VAT paid applicable to France. Consequently, in your monthly return for France, you can offset that input VAT.

Furthermore, you may also have deductible input VAT in France (or any other foreign country) for business expenses whose place of supply is France. However, such occurrences are much less frequent when your business is established elsewhere.

How Does EU VAT Work for Non-EU Amazon Sellers?

If your company is established outside of the EU and you're considering selling on Amazon Europe, you have two main options: distance sales or utilizing Amazon FBA.

If your company is established outside of the EU and you're considering selling on Amazon Europe, you have two main options: distance sales or utilizing Amazon FBA.

Distance sales are generally not an optimal choice for expanding into Europe due to the importance of delivery times and the benefits of participating in FBA. Sellers who fulfill their own orders from warehouses outside of the EU often struggle to achieve significant sales volume.

If you're a non-EU seller fulfilling orders from abroad (distance selling), Amazon automatically collects VAT on your sales. The responsibility for collecting and remitting VAT falls on the marketplace, representing one of the newer rules aimed at facilitating VAT compliance for non-EU companies.

For non-EU companies serious about expanding into Europe, Amazon FBA is typically the preferred option. As previously mentioned, VAT registration is necessary in each country where you maintain stock. However, for non-EU companies, VAT registrations can pose additional challenges. This is because you would likely need to appoint a fiscal representative—an EU company jointly responsible for VAT compliance.

Do I Need to Register for VAT if I Fulfil My Own Amazon Orders (Fulfilled by Merchant / MFN)?

If you fulfill your own orders without utilizing the Amazon FBA program, the determining factor for VAT registration in a foreign country is whether you maintain stock there.

There are two primary scenarios when fulfilling your own orders:

- Using a 3PL Warehouse: If you hire a third-party logistics (3PL) warehouse to store your stock and fulfill orders on your behalf, you'll need to register for VAT in the country where you store your stock.

- Distance Sales: If you send orders directly from your country of establishment via courier, you'll be conducting distance sales. In this case, you typically won't require additional VAT registrations beyond any tax obligations in your country of establishment.

How Many VAT Registrations Do You Need to Sell With Amazon FBA?

The number of VAT registrations required depends on your choice of Amazon fulfillment options, ranging from 1 to 8. The simplest approach for Amazon FBA, in terms of VAT and administrative burden, is to utilize the EFN (European Fulfillment Network). With EFN, you select one Amazon FBA warehouse to store your stock. From there, you can utilize the EFN to distribute your products to various EU countries of your choice, which you configure individually for each product you sell.

For instance, if you're a seller from Hungary participating in the Amazon FBA program and decide to send stock to a French FBA warehouse, you may want to sell your product not only in France but also in Germany, Italy, and Spain. EFN enables this flexibility, requiring you to register for VAT only in France. However, it's worth noting that cross-border sales may incur higher fees and longer delivery times compared to maintaining stock in each country where you intend to sell.

Alternatively, if you're an Amazon seller with solid sales potential and ample stock, distributing your inventory among multiple Amazon warehouses may be advantageous. This strategy can lead to lower order fees and improved Amazon rankings due to competitive pricing and faster delivery times. However, it necessitates VAT registration in all countries where you store stock, along with monthly VAT returns in each country. This adds complexity and expense to your accounting processes.

What About Intra-Community Sales in Europe - Do I Owe VAT on Those?

Yes, as an Amazon seller conducting sales in Europe, you are liable to pay VAT on any cross-border sales in the EU (intra-community sales).

Here are examples of such sales:

- Your business is based in Greece, and you sell on Amazon platforms in France, Germany, Italy, and Spain using the merchant fulfilled option. This means you send individual orders from Greece to be delivered to your customers in different countries.

- Your business is established in Greece, and you've dispatched stock to the Amazon warehouse in France, utilizing the EFN (European Fulfillment Network). You've chosen to accept orders from Italy and Germany, selling from your French warehouse to customers in Italy and Germany.

In both scenarios, you're conducting distance sales that require reporting and payment to the relevant authorities. VAT is payable at the place of supply, which for e-commerce physical products, is the country where the orders are delivered.

How Do You Pay VAT on Intra-Community Sales in Europe?

Continuing with the example above, if your business is solely registered for VAT in France but you've sold products to customers in Germany and Italy, how do you handle VAT for those transactions?

Continuing with the example above, if your business is solely registered for VAT in France but you've sold products to customers in Germany and Italy, how do you handle VAT for those transactions?

You utilize the OSS scheme for EU VAT. Amazon sellers surpassing an annual threshold of €10,000 in intra-EU sales are obligated to pay VAT where it is due. When selling to multiple EU countries, registering for VAT in each country can be impractical. Hence, the One Stop Shop (OSS) scheme was introduced. It enables you to pay VAT owed on intra-EU sales in one jurisdiction where you're registered—typically your country of establishment for EU companies, or an EU country where you're VAT registered as a non-EU seller.

Using the OSS scheme necessitates specific registration and regular reporting of taxable sales by country.

Wrap-Up

Amazon sellers conducting business activities in Europe must fulfill VAT obligations to ensure compliance, avoid penalties, and maintain smooth operations.

Both EU and non-EU sellers participating in the Amazon FBA program are required to register for VAT in each country where they store stock. Opting for the Pan-European program may necessitate VAT registration in up to 8 countries.

Non-EU sellers fulfilling orders with stock sourced from outside the EU should be aware that Amazon will handle VAT collection and payment on their behalf, relieving them of additional VAT obligations.

In summary, most Amazon sellers would typically require the following VAT registrations:

- VAT registration in their home country, if the business is established in the EU.

- VAT registration in any foreign country where stock is stored in a warehouse (Amazon FBA or 3PL), along with monthly filing of VAT returns covering all domestic sales.

- OSS registration and monthly reporting of sales to each EU country.

Ready to conquer the European market? Don't forget to consider your VAT obligations and associated costs as part of your expansion strategy. If you're seeking guidance on EU VAT compliance and automation, we're here to help. Contact us today to learn more and streamline your VAT processes.