All you need to know about VAT registration in the United Kingdom

Who is VAT liable in the UK

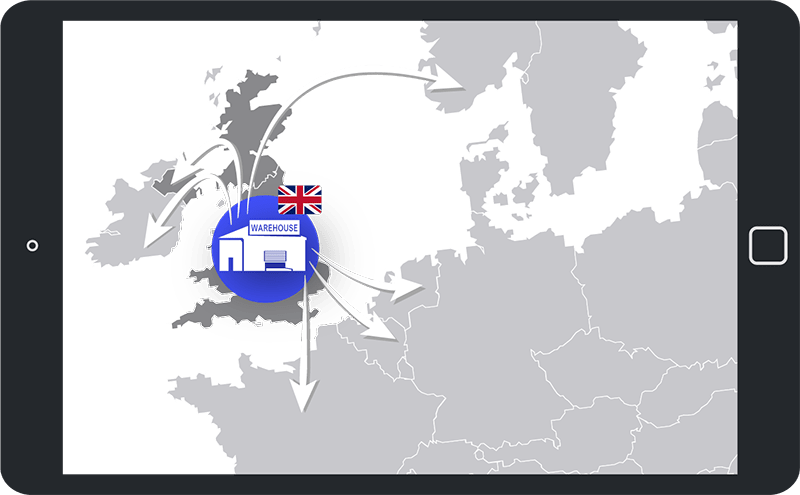

For e-commerce businesses operating in the UK, registering for VAT is necessary if you have stock stored there. Here are the primary situations that require VAT registration in the UK for non-UK companies:

Participating in Amazon's FBA programs and storing stock in Spanish warehouses

Storing stock in a warehouse that you have rented to keep your products and fulfill orders.

Storing stock in a UK warehouse rented from a 3PL fulfillment provider triggers the obligation to register for VAT in the UK. It's advisable to complete your registration before sending your stock to avoid customs clearance issues and import VAT reclaims.

For sellers utilizing Amazon FBA, it's important to understand the different FBA programmes and their VAT implications. Amazon's FBA programmes include:

Choose one country for stock storage, requiring registration in that country (e.g., Spain).

Choose multiple countries for stock storage, necessitating immediate VAT registration in the selected countries.

Distribute stock across up to 8 countries, including Spain. Register for VAT in all 8 Amazon FBA Pan European countries.

The process for obtaining a UK VAT ID differs slightly for EU and non-EU companies:

Requirements for becoming VAT registered

If you don't maintain stock in the UK, you don't need to register for a VAT number with HMRC. However, you still have VAT obligations if you sell to UK customers. Two main scenarios determine your VAT obligations for sales to UK customers without stock in the country:

Common questions answered

The standard VAT rate in the UK is 20%. However, there are reduced VAT rates applicable to certain goods and services. The reduced VAT rates in the UK are:

These reduced rates are applied to specific categories of goods and services, such as certain food items, books, newspapers, public transportation, and some medical supplies.

Before 2021, a distance selling threshold determined VAT registration obligations in the UK. For foreign businesses, this threshold was €35,000 in annual turnover. However, in 2021, this system was replaced by an EU-wide threshold of €10,000 for combined EU sales, irrespective of the country. If your intra-community sales exceed €10,000, you must pay VAT in each relevant country. Until this threshold is reached, you pay VAT for all sales, including intra-community ones, in your home country.

To streamline VAT collection for intra-community sales, the European Union introduced the One Stop Shop (OSS) scheme. Under OSS, you can report your intra-community sales in your home country and pay VAT in one consolidated submission. Your home country then distributes the appropriate VAT amounts to other EU countries based on your sales report.

Any business with a VAT number in an EU country can register for the OSS scheme and settle their intra-community VAT by submitting monthly or quarterly OSS declarations.

In international e--commerce and cross-border transactions involving the EU, sellers must inform clients about additional costs associated with imports unless they register for the IOSS scheme.

When selling to customers in the UK from a non-EU country, customers are responsible for paying import VAT and applicable duties. Typically, these fees are settled with the carrier (e.g., La Poste or DHL), which handles customs declarations and charges an additional fee for the service.

Sellers with significant sales volumes to France or other EU countries can benefit from registering for the IOSS. This allows them to streamline the purchasing experience for customers, avoiding additional fees for customs services and offering prices inclusive of VAT.

It's worth noting that the IOSS scheme is not limited to non-EU companies; it is open to all businesses selling goods imported into the EU with a value not exceeding €150.

If your business is registered outside the EU or EEA and you do not have an established presence in the United Kingdom for VAT purposes, you will need to appoint a tax representative there. The representative will act on your behalf to ensure compliance with VAT regulations. However, the requirement for a VAT representative depends on various factors, including your business activities and the specific regulations in place. It's advisable to seek professional advice to determine whether you need to appoint a VAT representative for your business in the UK.

The time it takes to register and receive a UK VAT number as a foreign company can vary due to several factors, including the complexity of the application and the efficiency of HMRC. Generally, the process takes around 4 to 6 weeks from the date of application submission. However, this timeframe can extend if there are any issues with the application or if additional documentation is required. Collaborating with experienced professionals or service providers like SimpleVAT can help streamline the process and ensure timely registration.

The time it takes to register and receive a UK VAT number as a foreign company can vary depending on several factors, including the complexity of the application and the efficiency of the local tax authorities. In general, the process typically takes between 8 to 12 weeks from the date of application submission. However, it's important to note that this timeframe can be longer if there are any issues with the application or if additional documentation is required. Working with experienced professionals or service providers like SimpleVAT can help streamline the process and ensure timely registration.

Let SimpleVAT manage the complexities of VAT registration, filing, and OSS/IOSS registration for your e-commerce business. Our expert team ensures compliance with UK tax regulations, allowing you to focus on scaling your business. Contact us today to discover more and embark on your journey!