All you need to know about VAT registration in the Czech Republic

VAT Guide

VAT in Czechia (Czech Republic) is called "Daň z přidané hodnoty" (DPH) and the local tax authority is the Czech Financial Administration (Finanční správa České republiky). The standard VAT rate in Czechia is 21%.

Czechia is one of the few EU countries that does not require non-EU companies to appoint a fiscal representative for VAT registration and ongoing compliance.

EU companies who need a Czech VAT number can voluntarily appoint a fiscal agent according to Section 110c of the Czech Sales Tax Act. The agent will not be responsible for tax tasks, but can act on behalf of your company to register for VAT and fulfill obligations.

Who is VAT liable in Czechia

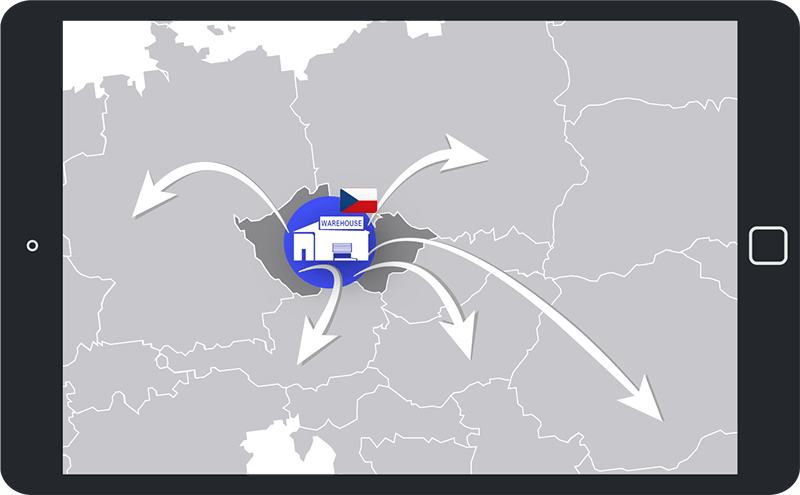

For e-commerce businesses operating in Europe, registering for VAT in Czechia is necessary if you have stock stored there. Here are the primary situations that require VAT registration in Czechia for non-Czech companies:

Participating in Amazon's FBA programs and storing stock in Spanish warehouses

Storing stock in a warehouse that you have rented to keep your products and fulfill orders.

Storing stock in a Czech warehouse rented from a 3PL fulfillment provider triggers the obligation to register for VAT in Czechia. It's advisable to complete your registration before sending your stock to avoid customs clearance issues and import VAT reclaims.

For sellers utilizing Amazon FBA, it's important to understand the different FBA programmes and their VAT implications. Amazon's FBA programmes include:

Choose one country for stock storage, requiring registration in that country (e.g., Spain).

Choose multiple countries for stock storage, necessitating immediate VAT registration in the selected countries.

Distribute stock across up to 8 countries, including Spain. Register for VAT in all 8 Amazon FBA Pan European countries.

The process for obtaining a Czech VAT ID differs slightly for EU and non-EU companies:

Requirements for becoming VAT registered

If you don't maintain stock in Czechia, you don't need to register for a VAT number in Czechia. However, you still have VAT obligations if you sell to Czech customers. Two main scenarios determine your VAT obligations for sales to Czech customers without stock in the country:

Common questions answered

The standard VAT rate in Czechia is 21%. However, there are reduced VAT rates applicable to certain goods and services. The reduced VAT rates in Czechia are:

These reduced rates are applied to specific categories of goods and services, such as certain food items, newspapers, pharmaceutical products, children's car seats and medical supplies.

There is a 0% rate on books.

For a more detailed breakdown of all VAT rates and categories of goods, please visit our EU VAT rates page.Before 2021, a distance selling threshold determined VAT registration obligations in Czechia. For foreign businesses, this threshold was CZK 1,140,000 (approximately €45,000 at the time) in annual turnover. However, in 2021, this system was replaced by an EU-wide threshold of €10,000 for combined EU sales, irrespective of the country. If your intra-community sales exceed €10,000, you must pay VAT in each relevant country. Until this threshold is reached, you pay VAT for all sales, including intra-community ones, in your home country.

To streamline VAT collection for intra-community sales, the European Union introduced the One Stop Shop (OSS) scheme. Under OSS, you can report your intra-community sales in your home country and pay VAT in one consolidated submission. Your home country then distributes the appropriate VAT amounts to other EU countries based on your sales report.

Any business with a VAT number in an EU country can register for the OSS scheme and settle their intra-community VAT by submitting monthly or quarterly OSS declarations.

In international e-commerce and cross-border transactions involving the EU, sellers must inform clients about additional costs associated with imports unless they register for the IOSS scheme.

When selling to customers in Czechia from a non-EU country, customers are responsible for paying import VAT and applicable duties. Typically, these fees are settled with the carrier (e.g., La Poste or DHL), which handles customs declarations and charges an additional fee for the service.

Sellers with significant sales volumes to Czechia or other EU countries can benefit from registering for the IOSS. This allows them to streamline the purchasing experience for customers, avoiding additional fees for customs services and offering prices inclusive of VAT.

It's worth noting that the IOSS scheme is not limited to non-EU companies; it is open to all businesses selling goods imported into the EU with a value not exceeding €150.

A VAT fiscal representative is not required in the Czech Republic, unlike most other EU countries.

The time it takes to register and receive a Czech VAT number as a foreign company can vary due to several factors, including the complexity of the application and the efficiency of local tax authorities. Generally, the process takes between 3 to 6 weeks from the submission date. However, this timeframe can extend if there are issues with the application or if additional documentation is required. Engaging experienced professionals or service providers like SimpleVAT can help expedite the process and ensure timely registration.

Let SimpleVAT manage the complexities of VAT registration, filing, and OSS/IOSS registration for your e-commerce business. Our expert team ensures compliance with Czech tax regulations, allowing you to focus on scaling your business. Contact us today to discover more and embark on your journey!