Streamline your EU VAT compliance with OSS and IOSS solutions from SimpleVAT

The One Stop Shop (OSS) is a VAT scheme introduced by the European Union in 2021 to simplify VAT compliance for businesses engaged in cross-border sales of goods and services within the EU. It replaced and extended the scope of the MOSS VAT scheme, which was primarily designed for businesses providing digital services.

Before the introduction of OSS, businesses had to register for VAT separately in each EU member state where they had customers, resulting in administrative complexities. OSS simplifies this process by allowing businesses to register for VAT in one EU member state and report and pay VAT on their cross-border sales through a single online portal.

OSS eliminates the need for VAT registrations in all countries where businesses sell goods or services, focusing instead on VAT registration in countries where they hold stock, such as through platforms like Amazon FBA. This targeted approach ensures compliance with VAT regulations while minimizing administrative overheads for businesses in cross-border trade within the EU.

There are two subtypes of the OSS scheme: Union OSS and Non-Union OSS.

The Union OSS scheme applies to businesses established within the European Union, allowing them to report and pay VAT on their intra-EU sales of goods and services to consumers (B2C transactions) in other EU member states through a single VAT return filed in their home country.

For businesses selling certain accommodation and digital services to EU customers, and who are established outside the EU, the non-Union OSS scheme enables them to register for VAT in one EU member state and report and pay VAT on their B2C sales of services to EU customers.

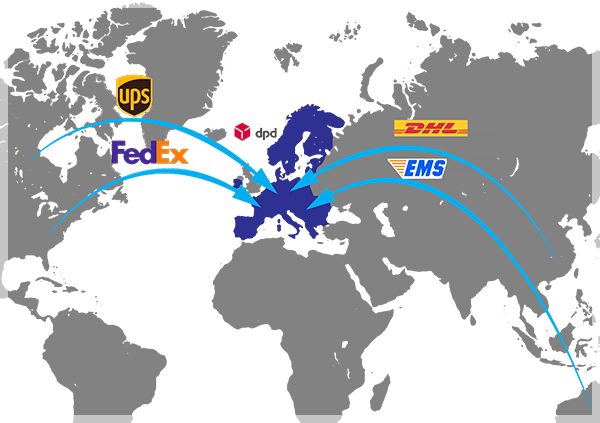

The Import One Stop Shop (IOSS) is a special variant of the OSS scheme designed specifically for the importation of low-value goods (consignments not exceeding €150) into the EU. IOSS simplifies the collection, declaration, and payment of VAT on these imported goods, making the process more efficient for both businesses and customs authorities.

While both OSS and IOSS are part of the same VAT simplification framework introduced by the EU, they serve different purposes:

The different OSS schemes all have one purpose - to offer a simplified way for online businesses to meet their EU VAT obligations, streamlining the process for both sellers and buyers. Understanding which scheme is suitable for your business is essential for efficient VAT management and seamless customer experiences. Below, we've compiled a comprehensive table outlining various scenarios to help you determine which EU One Stop Shop scheme aligns best with your business needs.

| Selling goods that originate from the EU | Selling services | Selling imported goods with a value of less than 150 EUR | |

| For EU Sellers | Register for OSS. EU sellers are advised to register for OSS in their home country, regardless of where they keep stock and if they have VAT registrations in multiple EU countries. |

Register for OSS. For EU sellers, the OSS scheme applies to B2C sales of both physical products and services. |

IOSS (optional) Both EU and non-EU sellers can benefit from the optional IOSS registration when sending their customer's orders from outside the EU to be imported. With OSS you achieve simple customs clearance, benefiting both you and your customer. You also collect the VAT at the point of purchase, which gives you the option to reclaim it on returned goods. |

| For Non-EU Sellers | Register for OSS. For non-EU sellers to ensure EU origin for goods, first they must be imported and stored in an EU warehouse (or Amazon FBA). Thus, obtain EU VAT registration in the importing country. You can then get an OSS registration in the same country. |

Register for non-Union OSS. Non-EU sellers should register for the non-Union OSS scheme when selling services to EU customers. |

Note that sellers can register for the One Stop Shop (OSS) scheme before reaching the intra-community sales threshold of €10,000. In fact, businesses are encouraged to register for OSS as soon as they begin making sales that qualify for the scheme, regardless of the sales volume.

To register for OSS, businesses need to fulfill certain requirements and submit the necessary documentation to the tax authorities of the EU member state where they are established. SimpleVAT offers a registration service to help businesses navigate the registration process efficiently.

Learn about the OSS registration process and filing.

Contact us today to learn more and get started with your OSS registration.

Businesses importing low-value goods (below 150 EUR) into the EU can register for IOSS to streamline their VAT obligations. SimpleVAT provides registration assistance to ensure businesses comply with IOSS requirements and facilitate smooth importation processes.

Learn about the IOSS registration process and filing.

Get in touch with us to register for IOSS and simplify your import VAT procedures.

Let us demystify OSS/IOSS and get you compliant, while also enabling you to offer a friction-free cross-border experience to your customers.