Learn how we help you attain the utmost level of accuracy while keeping manual labour to a minimum when doing your clients' books.

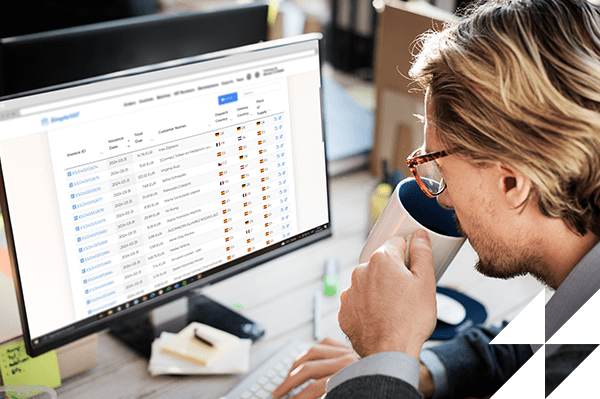

Accounting professionals offering e-commerce accounting services who deal with clients operating cross-border in the EU, rely on SimpleVAT's e-commerce accounting software to optimize their workflow by automating invoicing, sales data collection from all sales channels and processing that data with advanced algorithms, which take into account the vast EU VAT legislation to produce the exact figures needed for VAT filing in foreign jurisdictions and OSS/IOSS VAT declarations.

With first-class EU VAT software from SimpleVAT, you'll experience peace of mind knowing you have the resources to instantly calculate your client’s VAT obligations across all jurisdictions and do their reporting on time.

No matter how many e-commerce clients your accountancy firm has, how many VAT registrations they have, and what their volume of orders - doing the heavy lifting with SimpleVAT will allow you to meet those obligations and grow your business.

When it comes to filing EU VAT returns in foreign countries and reporting cross-border sales via the One Stop Shop (OSS/IOSS), manually compiling data from all the marketplaces and platforms where your clients sell can be a laborious and error-prone process. This becomes particularly challenging as filing deadlines draw near and accountants are burdened with heavy workloads.

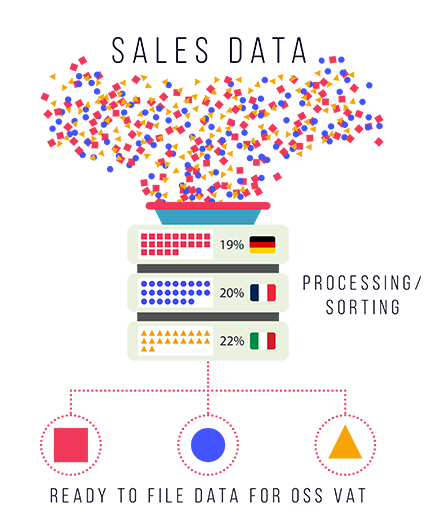

SimpleVAT offers a software solution that automatically collects sales data from all marketplaces and websites that your clients may be selling on, and applies advanced logic to process it accurately and give you the OSS data, the local VAT data, the foreign jurisdiction VAT data - everything needed for easy VAT filing, all in full compliance with the latest legislation.

Whether your clients sell on Amazon, Shopify, Etsy, Magento, WooCommerce, OpenCart, Kaufland, ManoMano, Veyton, Cdiscount, Ebay, Magento, or any other well-known marketplace, we have it covered. SimpleVAT connects to your clients' marketplace accounts and pulls in their sales data, creating accurate reports for you to use for filing their VAT returns.

Growing your accountancy firm hinges on your capacity to attract new clients while effectively managing your workflow. Yet, catering to the needs of e-commerce clients, especially in the realm of EU VAT, presents a distinct challenge that demands meticulous attention and consumes considerable time. This is why you need the best accounting software for e-commerce clients.

Our software integrates with all marketplaces and sales channels your clients use, centralising sales data collection and eliminating manual downloads.

Advanced algorithms process the data, distinguishing between local and cross-border supplies, apply the appropriate VAT rates, and generate accurate reports for VAT filings and OSS/IOSS declarations.

All e-commerce transactions are invoiced and are exportable via our web portal, simplifying VAT inspections and bookkeeping.

Say goodbye to manual B2B invoicing. SimpleVAT automates the process and performs VIES checks for EU VAT IDs automatically.

Our software fully eliminates any manual work in relation to currency conversion. FX conversion is performed using live data from the relevant central bank or rate-issuing institution obtained on the date of issuance of the invoice pertinent to each transaction and is subsequently used for reporting purposes.

Our software provides filterable data ranges, overview of sales and VAT due in pie chart format and in summary view, downloadable PDF invoices, downloadable main report with all transaction attributes (like place of origin, place of destination, currency, applicable reporting OSS/IOSS return or local VAT return, plus more).

We integrate with Xero and Quickbooks so you can easily transfer e-commerce sales data to your favourite app.

No. SimpleVAT's software is multi-tenant and allows you to manage all your clients' data using your own account. In case your clients also wish or require access to their own data, you can delegate access to them as needed.

It depends on the access level you have at your disposal to your client's Amazon account. If your client has delegated access to you via Seller Central then you can complete the setup in SimpleVAT on your own. Alternatively, if not, then you will need to grant them access to their company on SimpleVAT, and have them complete the setup themselves.

Yes, they can. If you're not ready to enrol in one of our packages for accountancy providers and establish your own payment method with us, you can simply advise your client to create their own account with us.

When you sign up for SimpleVAT as an accountancy firm, you receive a master account where you can add your clients. It is your company that pays for the SimpleVAT service. Additionally, you benefit from special discounts based on the number of clients you sign up.

Typically, yes. We encourage our accountancy provider partners to invite their clients to the platform interface, allowing them to track and review their sales and VAT statistics. We do not provide a white label solution, as we believe it is unnecessary. Our pricing structure ensures that end clients receive the same or better rates for using SimpleVAT compared to if they sign up via an accounting provider.

If you are providing the said client with domestic accounting services, there is no risk of the client switching to SimpleVAT. We do not offer an end-to-end accounting solution and therefore are not direct competitors to your service. We focus solely on EU VAT compliance and cannot handle the client’s domestic VAT or any other accounting services they may require. Furthermore, our service agreement with accountancy provider partners includes a clause about not working directly with your clients unless specifically requested by you and pertaining to services provided by SimpleVAT.

Ultimately, your clients require effective VAT compliance management, and they are unlikely to object as long as you do not charge them more than if you were to handle the work manually. You have two options for data collection in preparing EU VAT returns: manual or automated. If you can offer your clients a better price or faster and more efficient service through automation, it's a win-win situation. Your clients will appreciate knowing that you are leveraging advanced software solutions to minimize the likelihood of errors.

You can easily deactivate your SimpleVAT account and cancel any API integrations. Your invoices and all other reports and data are retained for up to 6 months and can be downloaded easily in bulk.

Partner with SimpleVAT and experience the transformative power of automated VAT management. Schedule a demo today and see how our software can streamline your operations, enhance efficiency, and drive success for your accountancy firm and your e-commerce clients.