SimpleVAT assists non-EU companies in registering for VAT by serving as their Fiscal Representative in all necessary European countries.

When registering for VAT in the EU as a non-EU company, most countries require a fiscal representative to be appointed. This is a locally tax registered company who will act on your behalf to take care of your VAT obligations, including filing and payment. As a full-service VAT compliance specialist, SimpleVAT offers fiscal representation services to non-EU companies, enabling their expansion into the European market.

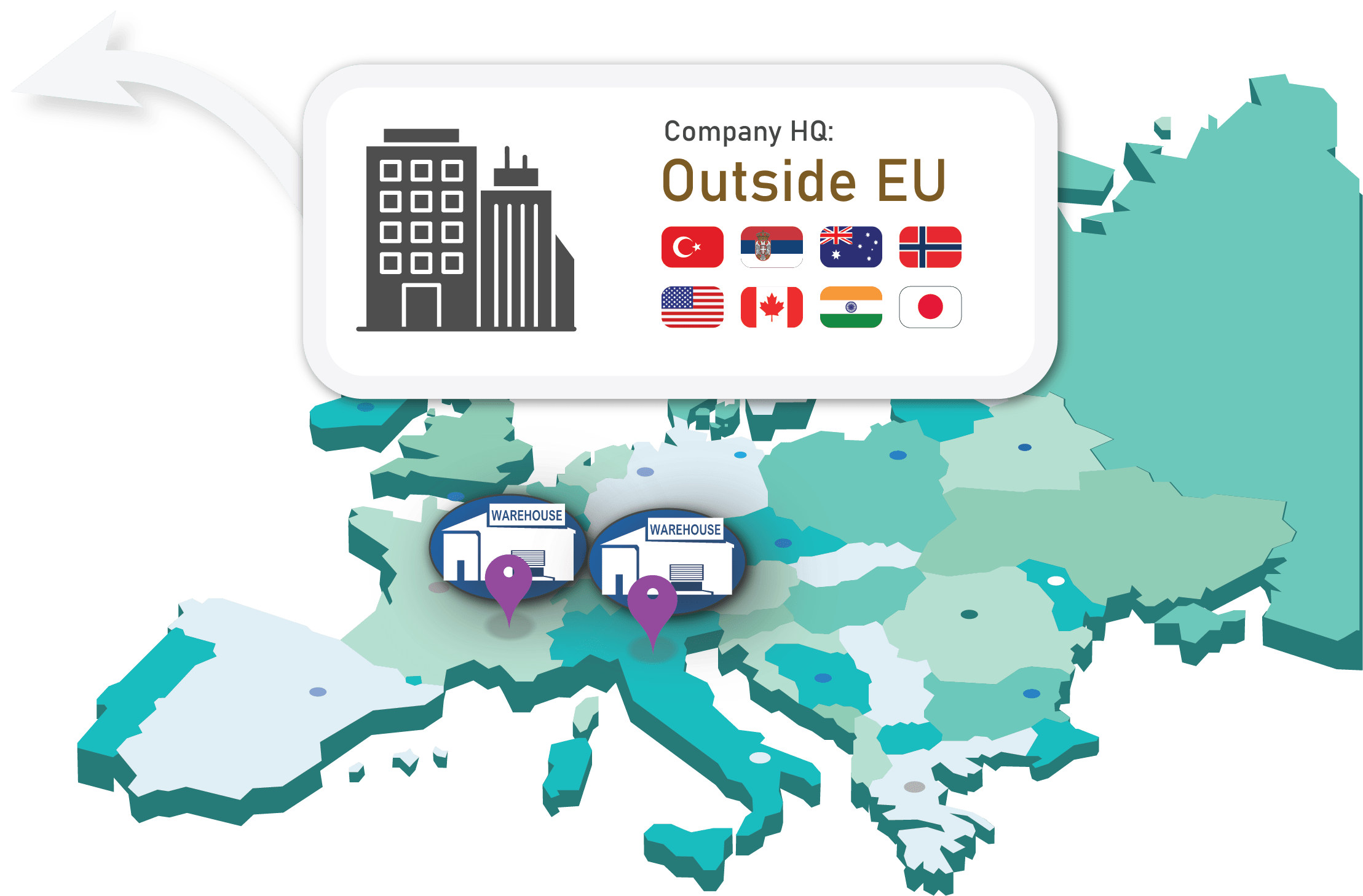

Businesses that are established outside of the European Union (EU) who are looking to engage in commercial activities which involve import of goods and using an EU warehouse. These activities trigger a VAT registration obligation, and most countries in the EU require this to be done by a fiscal representative who is a local company, which may also need to be specifically registered as a fiscal representative with the local tax authority.

A fiscal representative can be jointly or severally responsible for VAT obligations and payment. Since it is difficult for EU countries to enforce VAT compliance on non-EU entities, a local representative serves as a guarantee for compliance and a facilitator in communication between the two sides.

As a non-EU company with little to no connections in the particular country where taxable activities are expected to occur, finding a partner that can be liable for your VAT payments can be challenging. Due to the financial risk involved, it is an industry standard practice for companies offering fiscal representation to require a security deposit or bank guarantee to mitigate potential risks.

As part of our full-service VAT compliance offering, SimpleVAT provides comprehensive fiscal representation services to streamline your expansion into the EU market. We offer:

Our experienced network of partners in different countries act as your fiscal representative, ensuring compliance with VAT regulations and facilitating seamless transactions within the EU market.

For foreign businesses looking to expand into the EU, we offer VAT registration in an EU country through fiscal representation, enabling you to conduct business within the EU.

We also provide assistance with the registration of a limited liability company in an EU state, allowing non-EU businesses to establish a presence in the EU and gain access to VAT and OSS registration benefits.

| Software | Price |

|---|---|

|

SimpleVAT Pro

Includes

|

60.00 €

/ month

*

recurring

|

|

SimpleVAT Lite

Includes

|

25.00 €

/ month

recurring

|

| Service | Price |

|---|---|

| VAT registration | 190 € / country (one-off) |

| VAT filing |

69 €

/ country / month

recurring

|

| Import OSS (IOSS) filing |

120 €

/ month

recurring

|

| Union OSS (UOSS) filing |

120 €

/ month

recurring

|

| Non-Union OSS filing |

120 €

/ month

recurring

|

| VAT retrospective filing | 69 € / country / month (one-off) |

| VAT corrective filing | 60 € / country / month (one-off) |

Choosing the right VAT strategy is crucial for businesses operating within the EU market. At SimpleVAT, we offer expert consultation services to help you assess the advantages and disadvantages of different VAT setups and determine the most suitable strategy for your business.

Partner with SimpleVAT for expert fiscal representation services and gain peace of mind knowing your VAT obligations are in safe hands. Contact us today to learn more about how we can help you navigate the complexities of EU VAT compliance and achieve your business goals.

Get in touch to discuss your fiscal representation needs and how SimpleVAT can help.