We support VAT registration in key markets like the UK, France, Germany, Italy, Spain, Sweden, Czechia and Poland.

If you're an e-commerce company established in the EU but looking to store stock in another EU country—whether it's for Amazon FBA or utilizing a 3PL warehouse for efficient shipping (like the Netherlands)—you'll require VAT registration in one or multiple foreign EU countries. Similarly, non-EU businesses aiming to operate within the EU market typically need VAT registration in at least one country and may also require a fiscal representative.

Below are some of the countries where we offer VAT registration.

Foreign companies from the UK, USA, and other non-EU countries aiming to conduct business within the EU market can also benefit from our VAT registration services. We'll guide you through the process, ensuring compliance with all relevant regulations and requirements, and provide the necessary support to facilitate seamless entry into the EU market.

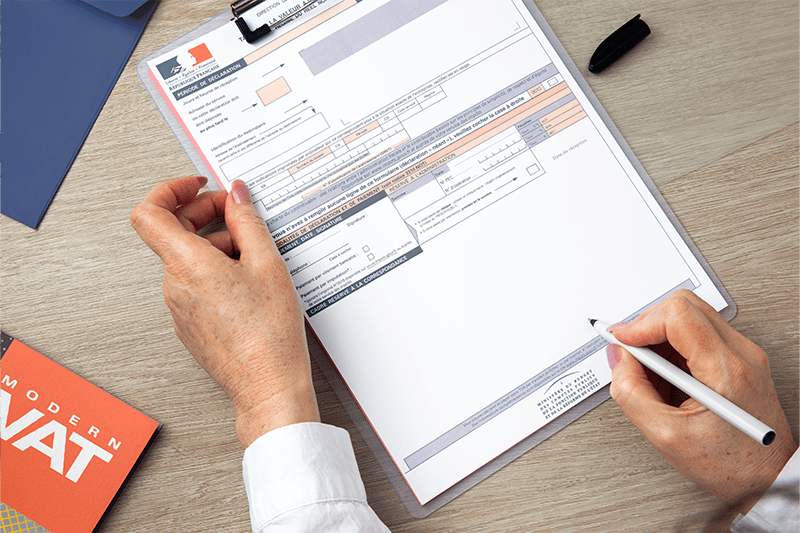

We specialize in understanding the intricacies of document submission and completion. While the registration process can be managed independently, our services offer significant time savings and minimize potential errors. The VAT registration fee is per country and includes all necessary translations, so the investment is well worth the efficiency gained.

Moreover, as a comprehensive service provider, we don't stop at registrations. We also handle VAT filings and offer access to our software service, where the data required for VAT returns and OSS reports is readily available, empowering you to manage your VAT obligations effortlessly.

Ready to streamline your EU VAT registration process? Partner with SimpleVAT today and experience unparalleled efficiency and expertise in VAT compliance.

| Software | Price |

|---|---|

|

SimpleVAT Pro

Includes

|

60.00 €

/ month

*

recurring

|

|

SimpleVAT Lite

Includes

|

25.00 €

/ month

recurring

|

| Service | Price |

|---|---|

| VAT registration | 190 € / country (one-off) |

| VAT filing |

69 €

/ country / month

recurring

|

| Import OSS (IOSS) filing |

120 €

/ month

recurring

|

| Union OSS (UOSS) filing |

120 €

/ month

recurring

|

| Non-Union OSS filing |

120 €

/ month

recurring

|

| VAT retrospective filing | 69 € / country / month (one-off) |

| VAT corrective filing | 60 € / country / month (one-off) |

VAT registration depends on the jurisdiction and can vary anywhere between a 4 and 12 weeks. Most countries require the necessary paperwork to be physically mailed to their tax agency's mailing address, while others have a completely digital process in place for VAT registrations. These differing requirements and practices lead to varying times for VAT registration.

Typically, the documents required for successful VAT registration are the company's articles of incorporation, the VAT certificate issued by the home jurisdiction's tax office, and a certificate of current standing issued by the home jurisdiction's commercial register agency.

Yes. We will take your documents and have our partner translation agency perform a certified translation of them. The target language they will be translate to will be the national language of the country where your application for VAT registration will be submitted to. For example, if you are a UK-headquartered company wishing to become VAT registered in Germany, you will give us your paperwork in English and we will have it translated to German.

Yes, our tax advisors will be happy to provide this information to you.

No, the payments you make must be denominated in the national currency of the country to which you are remitting payment. For Poland the currency is PLN, for Czechia it's CZK.

SimpleVAT will send you an automated email notification informing you that your return(s) has been filed. We will also include a reference number for the filing. You can also access real-time information on the status of your returns on the Schedule page in your account.

Yes, many countries allow for retrospective VAT registration. Please contact our support department if you require this option.

No. SimpleVAT's software is multi-tenant and allows you to manage all your clients' data using your own account. In case your clients also wish or require access to their own data, you can delegate access to them as needed.

It depends on the access level you have at your disposal to your client's Amazon account. If your client has delegated access to you via Seller Central then you can complete the setup in SimpleVAT on your own. Alternatively, if not, then you will need to grant them access to their company on SimpleVAT, and have them complete the setup themselves.

Yes, they can. If you're not ready to enrol in one of our packages for accountancy providers and establish your own payment method with us, you can simply advise your client to create their own account with us.

When you sign up for SimpleVAT as an accountancy firm, you receive a master account where you can add your clients. It is your company that pays for the SimpleVAT service. Additionally, you benefit from special discounts based on the number of clients you sign up.

Typically, yes. We encourage our accountancy provider partners to invite their clients to the platform interface, allowing them to track and review their sales and VAT statistics. We do not provide a white label solution, as we believe it is unnecessary. Our pricing structure ensures that end clients receive the same or better rates for using SimpleVAT compared to if they sign up via an accounting provider.

If you are providing the said client with domestic accounting services, there is no risk of the client switching to SimpleVAT. We do not offer an end-to-end accounting solution and therefore are not direct competitors to your service. We focus solely on EU VAT compliance and cannot handle the client’s domestic VAT or any other accounting services they may require. Furthermore, our service agreement with accountancy provider partners includes a clause about not working directly with your clients unless specifically requested by you and pertaining to services provided by SimpleVAT.

Ultimately, your clients require effective VAT compliance management, and they are unlikely to object as long as you do not charge them more than if you were to handle the work manually. You have two options for data collection in preparing EU VAT returns: manual or automated. If you can offer your clients a better price or faster and more efficient service through automation, it's a win-win situation. Your clients will appreciate knowing that you are leveraging advanced software solutions to minimize the likelihood of errors.

You can easily deactivate your SimpleVAT account and cancel any API integrations. Your invoices and all other reports and data are retained for up to 6 months and can be downloaded easily in bulk.

Yes. SimpleVAT supports all of the European Amazon marketplaces.

Yes. Any legal entity incorporated beyond the bounds of the E.U. is required to appoint a fiscal representative. Please contact our sales department to find out details concerning our fiscal representation services.

Absolutely. SimpleVAT's software is built in accordance with the latest E.U. and U.K. legal frameworks on Value Added Tax. Your sales to Northern Ireland will be correctly handled in all cases, both if you are an E.U.-based legal entity or otherwise.

Absolutely. SimpleVAT's software is highly sophisticated and is capable of handling all possible tax scenarios, which includes all of the European territories which are assigned special (exempt) tax status.

Yes. Inside your SimpleVAT account you can specify whether you wish to have us file your returns on a per-VAT number basis. For example, let's assume your company is VAT registered in France, Germany and Italy, and you wish SimpleVAT to file your monthly VAT returns in Italy and France only. You can log in to your SimpleVAT account and navigate to 'VAT Numbers' where you can amend the settings for your French and Italian VAT numbers, thereby indicating to us that you wish to have SimpleVAT assume the responsibility of filing the returns. Please note that your monthly subscription fee will be adjusted accordingly.

Absolutely. Please log in to your SimpleVAT account and choose a subscription plan which best suits your needs. If you need us to, we can arrange VAT registration in all of the Pan-EU FBA countries, including France, Germany, Italy, Spain, Netherlands, Poland, Czechia, and Sweden.

The Amazon VAT Calculation Service (VCS) is a free means of having VAT invoices generated for your Amazon orders only. Amazon VCS does not include filing of VAT returns. This means you remain obligated to generate invoices for your orders coming from your other sales channels, and also for filing your VAT/OSS returns.

The asking price for Amazon VAT Services for filing VAT returns is 35 EUR/country/month which may seem affordable, but is really not. For one, this price is applicable if you have only Amazon orders to report on your VAT returns. Usually, sellers do business on multiple marketplace platforms and also via their own website(s). Using Amazon VAT Services to report these non-Amazon transactions increases the price to 150 EUR/country/month, which is far from affordable. Also, their service lacks API integration with competing marketplaces even if you are willing to pay the high price. Also worth mentioning is the fact that Amazon VAT Services does not include filing One Stop Shop (OSS) returns.

In summary, choosing SimpleVAT over Amazon VAT Services makes a lot more sense, both economically and from a practical perspective, given the fact that SimpleVAT offers automation for all your sales channels (not just Amazon), includes both VAT and OSS returns, and costs less than Amazon VAT Services overall.

No. There is no such risk. SimpleVAT's tax engine is fully in line with Amazon's tax engine (which uses Vertex technology). This assessment is offered based on having compared hundreds of thousands of invoices generated by SimpleVAT to VAT data from Amazon's VAT Calculation Service (VCS). This means that we will attribute due VAT amounts in exactly the same way as Amazon and following the exact same rules. In other words, it is impossible to have a situation where Amazon attributes a transaction's VAT amount as due to country X, and have SimpleVAT attribute it to country Y.

Yes. SimpleVAT monitors your Amazon orders and our tax advisors will inform you if Amazon has started to ship orders from fulfilment centres in a country where you are currently not VAT registered.

No. These orders are non-compliant with regard to EU tax law and SimpleVAT will not invoice them. If you subsequently become VAT registered in Sweden retrospectively, you can instruct SimpleVAT to go back and generate invoices for them.

Yes, you can grant access to your account to one or more team members.

Absolutely. SimpleVAT's tax engine is fully in line with the latest U.K. and E.U. regulations on VAT. As such, it has a robust implementation of all the relevant tax rules, including the marketplace facilitator mechanism encompassing the 135 GBP (U.K.) and 150 EUR (E.U.) consignment thresholds, the ability to differentiate whether the marketplace facilitator mechanism applies or not on a per-order basis (knowing if the order is placed via a marketplace or the seller's own website(s)), and many more factors.

Yes. The ship-from country is an essential piece of information which SimpleVAT requires in order to yield an accurate result. In case your e-commerce shop software does not make this information available out of the box, your technical department can integrate with SimpleVAT via our API to deliver this data.

Absolutely. We welcome your decision to do so. When making the switch, please make sure to time things in a manner which allows enough technological time to get yourself set up with SimpleVAT (configure marketplaces, input your VAT numbers, etc.) before your next VAT return becomes due. For example, if your company is filing monthly returns in France, the best time for making the switch to SimpleVAT is shortly after the 19th of the month which is when your previous tax provider would have filed your monthly VAT return in France at the latest. This would ensure we have ample time to have your SimpleVAT account set up and your VAT return collated before it is due on the 19th the following month. If in doubt regarding the best time to make the switch, please contact us.

Yes. SimpleVAT has a large number of integrations, including with Amazon, eBay, ManoMano, Cdiscount, Shopify, Magento, Kaufland, and many more. In all likelihood, we already have the necessary technological means to accommodate all of your selling channels. On the off chance that you sell through a less well-known channel which we currently do not support, you have our commitment to have our tech staff implement the necessary integration steps during your onboarding, such that API integration is made available for all of your selling channels before your next VAT/OSS return is due.

It is our responsibility to file your VAT/OSS returns on time. Unless we provide fiscal representation services to your company, the actual payment of any amount stated on the return shall remain your responsibility.

No.

At the very least, SimpleVAT can automate your invoicing. Manually issuing invoices can be time consuming and error prone. SimpleVAT solves these problems by connecting to your website(s) over API and generating invoices for your orders.

If you sell internationally throughout Europe, it is very likely that your company is required to file monthly or quarterly One Stop Shop (OSS) returns. SimpleVAT can be of great help here. Our tax advisors can file your OSS returns for you, or we can provide you with a monthly/quarterly report containing all the data needed by your accountant to submit the filings themselves.

It depends on your VAT obligations and current VAT/OSS status. If your VAT obligations do not change over time, then no matter how many new marketplaces you start selling on, your SimpleVAT subscription will likely not need changing. For example, you currently sell on Amazon (non-FBA), you have one warehouse, and you are already OSS registered. Later on you start selling on ManoMano and Cdiscount, whilst the aforementioned circumstances of your business remain the same. In this case there is no need to change anything about your SimpleVAT subscription and you can freely connect as many new marketplaces to your SimpleVAT account is necessary at no extra cost.

Absolutely. Sign up for SimpleVAT and make the relevant settings in your account to specify which services you wish to have us provide. For example, let's say your company is incorporated and VAT registered in France, and is also VAT registered in Germany and Italy. If you wish to have your accountant take care of matters in France only, go to 'VAT Numbers' in your SimpleVAT account, find your French VAT number and check the checkbox labelled 'I will make arrangements to file VAT returns on my own', while also making sure to uncheck this checkbox for your German and Italian VAT numbers. The relevant setting for who files your OSS return is also available in the same section of your account.

Yes, this kind of setup is possible. There will be the need to coordinate VAT/OSS filing between us and your accountant to ensure both parties are on the same page with regard to your taxes so you don't pay VAT twice.

We accept all major debit/credit cards including Visa, Mastercard, JCB, and Amex. You need to have a card on record with us which we will use to charge your subscription fee once every month/quarter/year (depending on your chosen billing cycle).

Paying for a year ahead comes with the advantage of enjoying a considerable discount. Check the pricing page on our website to find out how much you would save.

Yes, you may pay on a quarterly basis. This option is mostly used by our clients who are OSS registered and submit quarterly returns.

Absolutely.

Yes. By default, our website will offer you pricing in GBP. However, if you wish to be billed in EUR, please contact our sales team to get you set up.

Yes. As well as EUR, we support a number of additional currencies, including GBP, PLN, CZK, HUF, SEK and NOK. We try to match your browser's geolocation to the appropriate currency automatically. If our website does not offer our pricing for our subscription plans in your national currency, please contact our sales team to get your subscription set up in the currency of your choosing.

Your subscription will be charged once every month on the day following the expiry date of your free trial period. For example, if you signed up on March 6th, your trial will have expired on April 5th and your subscription fee will be charged on the 6th every month from there on out.

We offer our subscription plans with monthly, quarterly or annual billing. By choosing quarterly or annual billing you can take advantage of a discounted price for your subscription. Please check the relevant pricing page on our website for details.

The invoices are available in the Billing section in your SimpleVAT account.

SimpleVAT's billing engine is fully automated and invoices for subscription fee payments are issued automatically as soon as your card is charged.

Given the sensitive nature of our service, we will grant a 5-day grace period before we take any action on your account. We will send you a reminder via email informing you of the payment issue and the recommended steps to resolve it. If the grace period is passed and the issue remains unresolved, SimpleVAT will stop generating invoices for new orders. All other aspects of your account will continue functioning as normal. This means you will be able to access all data pertaining to periods prior to the suspension normally without any impediments. However, until the payment issue is resolved our tax advisors will not file new VAT/OSS returns.

Ready to streamline your EU VAT registration process? Partner with SimpleVAT today and experience unparalleled efficiency and expertise in VAT compliance.