From small to large sellers, EU-based or HQed outside the EU, selling in multiple currencies or just one, fulfilling with 3PL or FBA, SimpleVAT has you covered.

SimpleVAT was created to simplify and demystify EU VAT compliance. Explore the impact of our automated invoicing and put EU VAT reporting on autopilot – reducing risks of inaccurate declarations, unlocking new opportunities to expand to new markets by saving you time on your returns, and ultimately freeing you from the burden of tax reporting so that you can focus on business growth instead.

Embrace a seamless approach to VAT filings with SimpleVAT.

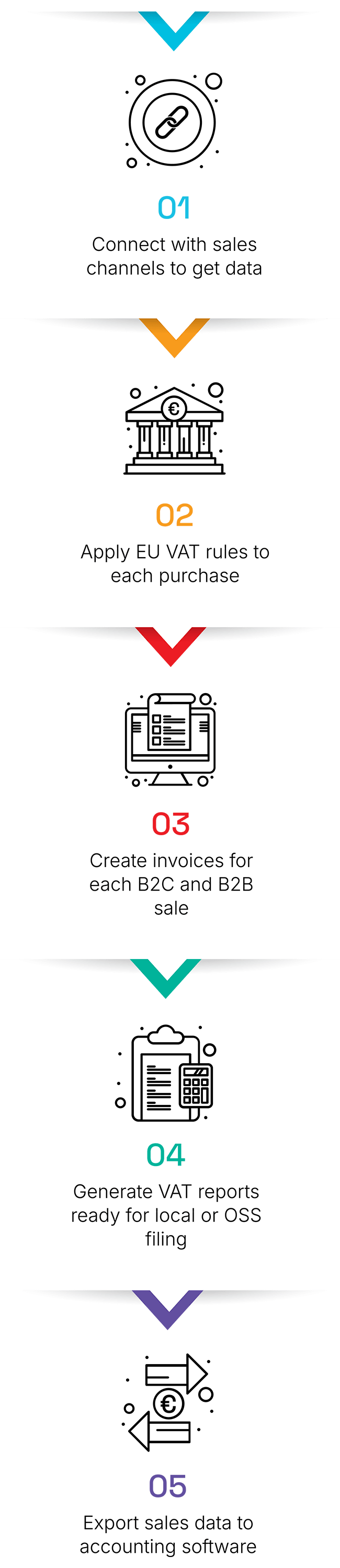

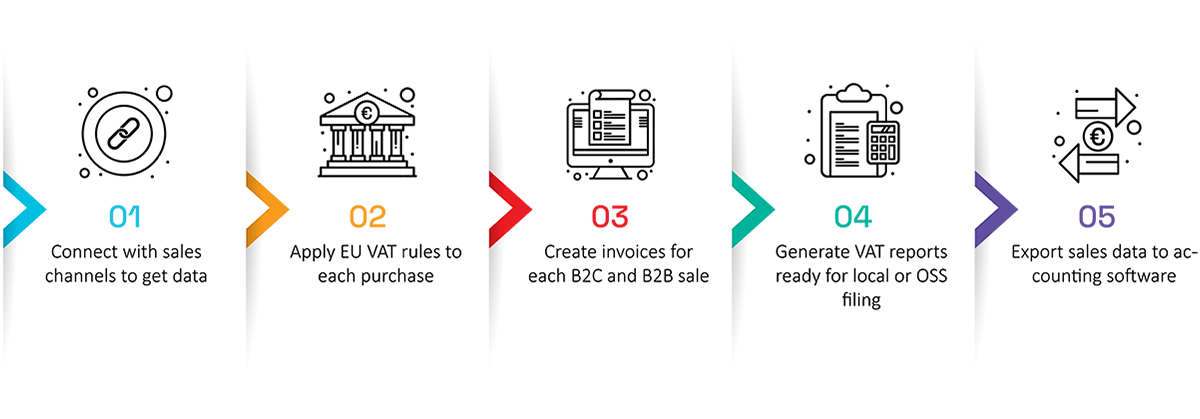

Discover how SimpleVAT automates your accounting processes and simplifies the management of online sales.

A centralized invoicing system that seamlessly integrates with all your sales channels. Invoices are automatically generated with sequential numbering, fully compliant with legal requirements, eliminating the need for manual creation or forwarding to your accountant.

Automatically issue and email electronic receipts directly to your customers. Say goodbye to physical cash registers and reduce the manual workload associated with them.

Automated currency conversion with up-to-date exchange rates. Streamline your operations by eliminating manual currency conversions when selling in non-euro countries.

Automated integration with the VIES system for real-time VAT number verification during B2B sales. Ensure speed and accuracy in invoicing while avoiding potential errors.

Real-time integration with your online store for instant extraction of sales data, ensuring it’s readily available for both you and your accountant.

Multi-user access for seamless collaboration. Enhance teamwork between you and your accountant for efficient invoice management and data retrieval.

Automatically generates comprehensive VAT reports, including OSS, IOSS, foreign VAT (for registrations in other countries), and domestic filings in Bulgaria. Receive ready-to-submit data for all your VAT returns.

Effortlessly export sales data directly into your accounting software, eliminating the need for manual entry. Ideal for online store owners looking to reduce accounting costs.

Supports REST API for custom integrations. Easily connect SimpleVAT with your existing business systems, such as warehouse management, for maximum efficiency.

Take a look at SimpleVAT’s interface and see how our software automates your VAT compliance. Want to see more? Click on "Demo" and try it out for yourself.

Adapt to an ever-changing compliance landscape. SimpleVAT is built on the latest EU VAT compliance requirements and is coded using smart technologies that allow us to quickly release new versions, upgrade and adapt, no matter what tax authorities demand