Delivering a hassle-free VAT compliance experience with our proprietary SimpleVAT software, which integrates with leading e-commerce platforms to transform how you do VAT filing and automate invoicing.

Ensuring flawless data collection and giving you the data needed to file OSS and foreign VAT returns effortlessly, SimpleVAT streamlines your EU VAT filings and saves you time.

SimpleVAT integrates seamlessly into your E-commerce business so you can enjoy a user-friendly solution to VAT compliance, making the chore of compiling EU sales data effortless and precise. Leverage top-tier technology and our extensive expertise in EU VAT for your business's seamless and sustainable growth.

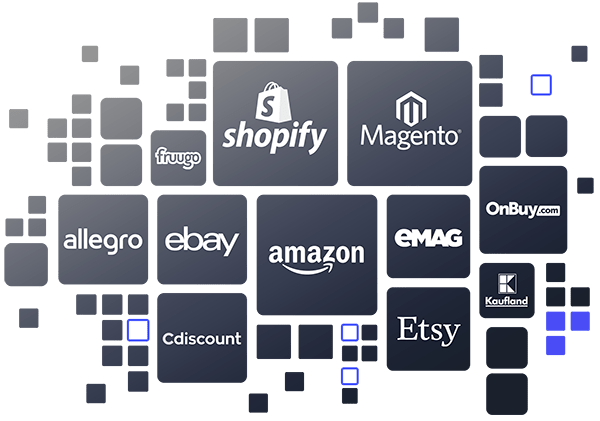

To achieve full automation in data collection for filing your EU VAT returns and submitting your OSS declaration, you need software that integrates with ALL platforms you sell on, including all marketplaces and your website.

At SimpleVAT we're proud to provide a cost-effective and easy-to-use tax solution, which integrates with an extensive list of marketplaces and website CMS platforms.

Our expanding clientele, both large and small, relies on us to streamline their tax compliance across all platforms they use.

Created to simplify EU VAT compliance, our innovative VAT technology does just that. Whatever your needs, our experts at SimpleVAT have the solution.

For businesses large and small - from single website shops that sell to customers in Europe, to full-fledged e-commerce businesses with a presence on multiple marketplaces, who keep stock in several countries, or use Amazon’s FBA program to do so - SimpleVAT provides the tools and expertise to ensure you meet your EU VAT obligations. Anytime, Anywhere.

Selling to customers in Europe? Your EU-wide threshold for B2C distance sales is EUR 10,000 worth of goods within the EU. Above this threshold, you are required to register for EU VAT preferably with the OSS scheme, which allows you to register in one country and submit returns and pay VAT in just one country, which simplifies your VAT compliance efforts.

Are you already selling with Amazon FBA or planning a full Pan-European expansion? It's important to know that Amazon may store your stock and distribute it to multiple EU warehouses, which triggers an obligation to get VAT registered in each country where the stock is kept. You can leverage professional services for VAT registrations and filing.

As an accountant you know that the first challenge you face in submitting EU VAT returns for online businesses, is to gather accurate sales data per country. SimpleVAT provides automation to remove all inaccuracy in sales data and compile data from all sales channels, including the correct VAT rates per product and per country.

Automate your EU VAT compliance effortlessly with SimpleVAT. Our cutting-edge software solution not only saves you valuable time but also contributes positively to your bottom line. Let technology handle the complexities while you focus on growing your business. Experience efficiency, accuracy, and financial benefits – all in one seamless package.

SimpleVAT automates your EU VAT compliance in a cost-effective way, saving you and your accountant time, which contributes positively to your bottom line.

SimpleVAT is the trusted choice for businesses worldwide, ensuring seamless VAT compliance across diverse industries and international borders. Join a community of satisfied online sellers who rely on our proven expertise.

Experience the power of SimpleVAT's proprietary software - a tech-driven solution for automatic invoicing, marketplace integration, and hassle-free VAT returns. Elevate your e-commerce business with consistent excellence in EU VAT compliance.

Unlock the full potential of SimpleVAT with a complimentary consultation from our dedicated VAT specialists. From integration to implementation, our experts are here to guide you through every step. Your success in EU VAT compliance starts with personalized support – all at no cost to you.

Неочаквани предизвикателства при стартирането на своя онлайн бизнес с Amazon FBA

Unlock the full potential of SimpleVAT with a complimentary consultation from our dedicated VAT specialists. From integration to implementation, our experts are here to guide you through every step. Your success in EU VAT compliance starts with personalized support – all at no cost to you.